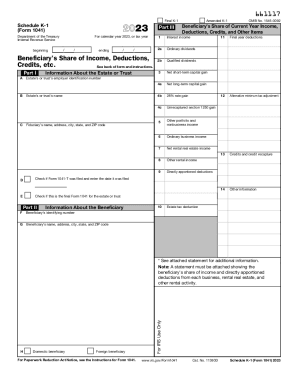

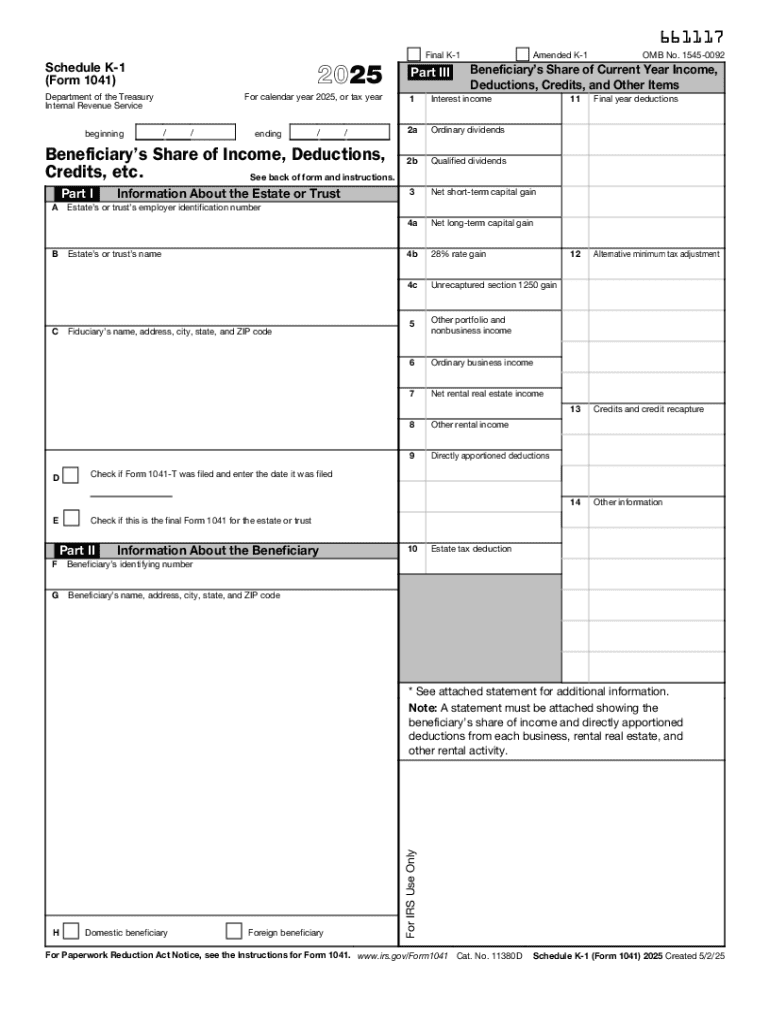

IRS 1041 - Schedule K-1 2025 free printable template

Instructions and Help about IRS 1041 - Schedule K-1

How to edit IRS 1041 - Schedule K-1

How to fill out IRS 1041 - Schedule K-1

Latest updates to IRS 1041 - Schedule K-1

All You Need to Know About IRS 1041 - Schedule K-1

What is IRS 1041 - Schedule K-1?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1041 - Schedule K-1

How can I correct an error on my IRS 1041 - Schedule K-1?

To correct an error on your IRS 1041 - Schedule K-1, you should prepare a new Schedule K-1 indicating the correct information and file it with the IRS along with a statement explaining the error. If the original K-1 was already issued to beneficiaries, make sure to inform them of the corrections.

What should I do if I receive a notice from the IRS regarding my submitted Schedule K-1?

If you receive a notice from the IRS about your Schedule K-1, review the notice carefully to understand the issue being raised. Gather and prepare any required documentation to support your case, and respond promptly, typically within the timeframe specified in the notice to avoid penalties.

Can I e-file my IRS 1041 - Schedule K-1 using tax software?

Yes, you can e-file your IRS 1041 - Schedule K-1 using certified tax software that supports e-filing. Ensure that the software is compatible with the specific IRS requirements and that it meets any technical specifications necessary for processing your form.

Are there specific requirements for nonresidents when filing IRS 1041 - Schedule K-1?

Nonresidents receiving an IRS 1041 - Schedule K-1 must ensure accurate reporting of income connected to U.S. sources. They may also need to consider any tax treaties that affect their tax obligations and might require additional forms when submitting their returns.

What common mistakes should I avoid when preparing my IRS 1041 - Schedule K-1?

Common mistakes to avoid when preparing your IRS 1041 - Schedule K-1 include misreporting income amounts, not identifying all beneficiaries accurately, failing to provide complete information, and not signing the form. Double-check all entries for accuracy to prevent potential issues.